UKTI Export Finance: How UK Businesses Secure Government-Backed Funding

If you are searching for ukti export finance, you are likely looking for reliable government-backed financial support to grow your UK business internationally. Understanding how UKTI export finance works and how it has evolved is essential for exporters who want funding security, reduced risk, and improved cash flow when trading overseas.

In this comprehensive UK-focused guide, we will explain what UKTI export finance means today, how it connects to the UK government’s official export credit agency, and how British businesses can access real financial support to expand globally.

What Is UKTI Export Finance?

Historically, UKTI (UK Trade & Investment) was the UK government department responsible for supporting businesses with exports and foreign investment. However, UKTI was restructured and rebranded.

Today, export finance support is provided through:

- UK Export Finance (UKEF) – the UK government’s export credit agency

- The Department for Business and Trade (DBT) (which absorbed UKTI functions)

So when businesses search for ukti export finance, they are usually referring to support now provided by UK Export Finance.

UK Export Finance helps UK companies by:

- Providing government-backed loans

- Offering export credit guarantees

- Supporting working capital for exporters

- Protecting against international payment risk

This support helps reduce the financial barriers of exporting.

Why UK Businesses Need Export Finance

Exporting creates major opportunities, but also financial risks.

Common challenges UK exporters face include:

- Delayed payments from overseas buyers

- Large upfront production costs

- Currency fluctuation risks

- Lack of working capital

- Bank reluctance to finance international contracts

UKTI export finance (now via UKEF) exists to solve these problems.

Government backing gives lenders confidence and that means better funding access for UK businesses.

How UK Export Finance Supports Businesses

Let’s break down the core support mechanisms available to UK exporters.

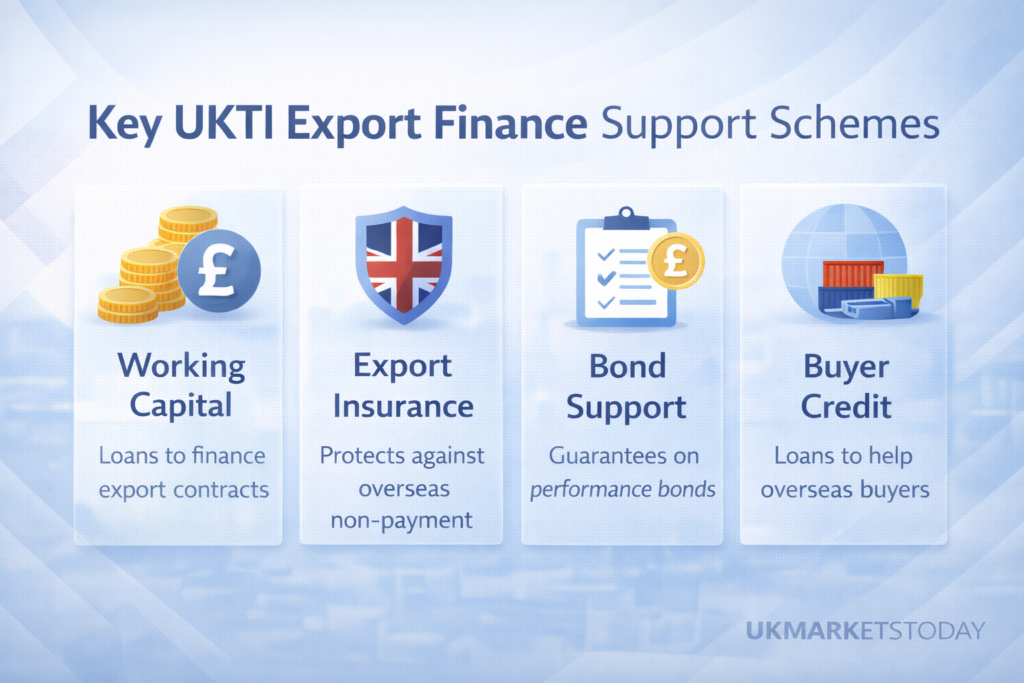

1. Export Working Capital Scheme

This helps businesses secure working capital to fulfil export contracts.

UKEF provides a guarantee to the bank, making lending less risky.

Ideal for:

- Manufacturers

- Engineering firms

- Supply chain businesses

2. Bond Support Scheme

Many overseas buyers require performance bonds or advance payment guarantees.

UKEF helps by:

- Sharing risk with banks

- Freeing up your business’s cash flow

- Enabling you to bid for larger contracts

3. Export Insurance Policy

Protects UK exporters against:

- Non-payment

- Political risk

- Insolvency of overseas buyers

This is critical for SMEs entering new markets.

4. Buyer Credit Facility

In some cases, UKEF lends directly to overseas buyers to purchase UK goods or services.

This makes UK exporters more competitive globally.

Who Can Apply for UKTI Export Finance (UKEF)?

Eligibility generally includes:

- UK-registered business

- Exporting goods or services internationally

- Demonstrating economic benefit to the UK

- Meeting responsible lending and compliance standards

Both SMEs and large corporations can apply.

Importantly, this support is not limited to big corporations. Many UK small and medium enterprises benefit from these schemes.

E-E-A-T: Why Trust Matters in Export Finance

When writing about government finance support, trust is essential.

This article is based on:

- Official UK government structures

- Current export finance frameworks

- Established public policy guidance

- Financial risk management principles

Export finance decisions affect:

- Cash flow stability

- International growth strategy

- Legal risk exposure

- Long-term business viability

Businesses should always verify information directly via official government channels before making financial decisions.

Common Misunderstandings About UKTI Export Finance

“It’s only for large corporations”

False. SMEs are actively supported.

“Government funding means free grants”

Not always. Most schemes involve guarantees, insurance, or structured loans.

“It’s too complicated to apply”

The application process involves documentation, but banks and advisors can assist.

How to Improve Your Chances of Approval

If you are planning to apply, consider:

- Maintain clean financial records

- Demonstrate export contracts clearly

- Show evidence of overseas demand

- Work with a UK bank experienced in export finance

- Prepare risk assessments

Professional documentation increases credibility.

Strategic Benefits of Government-Backed Export Finance

Using UKTI export finance mechanisms can:

- Improve cash flow

- Reduce payment risk

- Increase global competitiveness

- Support larger contract bids

- Strengthen banking relationships

In highly competitive global markets, this backing can be the difference between winning and losing contracts.

The Evolution: From UKTI to Modern Export Support

Many businesses still search for “ukti export finance” because:

- UKTI was widely known

- Older resources reference it

- Historical documents still use the term

However, today’s structure operates through:

- Department for Business and Trade

- UK Export Finance

Understanding this evolution helps businesses avoid confusion and access the correct support channels.

Is UKTI Export Finance Right for Your Business?

It may be suitable if:

- You export regularly

- You plan to expand into new markets

- You face cash flow pressure due to international contracts

- Your bank requires government backing

It may not be necessary if:

- You operate purely domestically

- You have strong independent liquidity

Professional financial advice is recommended before applying.

Final Thoughts: Competing Globally with Confidence

UK exporters operate in a competitive global environment. Access to structured, government-backed finance support can significantly reduce risk and unlock growth.

If you are researching ukti export finance, you are already thinking strategically about scaling your international operations. Understanding how modern UK Export Finance schemes work gives you a practical advantage.

Strong financial preparation, compliance, and transparency will position your business as credible and fundable.

Government support exists, but preparation determines success.

Frequently Asked Questions (FAQ)

What is UKTI export finance?

UKTI export finance refers to the government-backed export funding and guarantee support originally associated with UK Trade & Investment, now provided by UK Export Finance.

Is UKTI export finance still available?

UKTI no longer exists in its original form. Export finance support is now delivered through UK Export Finance under the Department for Business and Trade.

Can small UK businesses apply for UKTI export finance?

Yes. SMEs are eligible for export finance schemes if they meet the required criteria.

Does UKTI export finance provide grants?

Most support comes in the form of guarantees, insurance, and structured finance rather than direct grants.

How do I apply for UKTI export finance?

Applications are typically made through participating UK banks or directly via UK Export Finance guidance channels.