Credit Score Ranges in the UK: What They Mean and How to Improve Yours

Understanding credit score ranges is essential for anyone in the UK applying for a mortgage, personal loan, credit card, or even a mobile phone contract. Credit ranges determine how lenders assess your reliability, influence the interest rates you receive, and directly impact your financial opportunities.

In this comprehensive UK guide, we explain how credit ranges work, how the major UK credit reference agencies calculate scores, what is considered a good credit score, and how you can improve your position responsibly.

Reviewed using official UK credit reference agency guidance, FCA financial standards, and trusted consumer finance resources.

What Are Credit Score Ranges?

It represent numerical bands used by lenders and credit reference agencies to classify your creditworthiness.

In the UK, there isn’t one universal credit score. Instead, three main credit reference agencies operate independently:

- Experian

- Equifax

- TransUnion

Each uses slightly different scoring systems, which means your score can vary between providers.

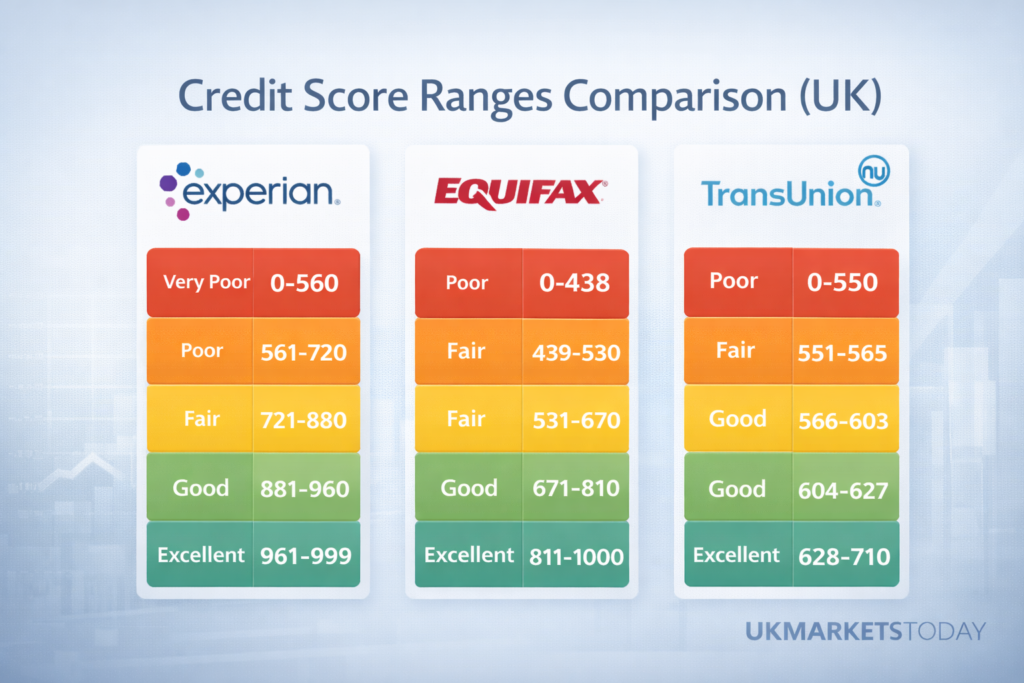

Credit Score Ranges by UK Agency

Experian Credit Score Ranges (UK)

- 0–560: Very Poor

- 561–720: Poor

- 721–880: Fair

- 881–960: Good

- 961–999: Excellent

Equifax Credit Score Ranges (UK)

- 0–438: Very Poor

- 439–530: Poor

- 531–670: Fair

- 671–810: Good

- 811–1000: Excellent

TransUnion Credit Score Ranges (UK)

- 0–550: Very Poor

- 551–565: Poor

- 566–603: Fair

- 604–627: Good

- 628–710: Excellent

Because credit score ranges differ, lenders typically review your full credit report, not just the number.

Why Credit Score Matter

Credit score influence:

- Mortgage approvals

- Credit card limits

- Personal loan eligibility

- Interest rates

- Car finance approval

- Rental applications

A higher score generally results in:

✔ Lower borrowing costs

✔ Higher approval chances

✔ Better credit offers

However, lenders also consider:

- Income stability

- Employment history

- Existing debt levels

- Affordability checks

Your credit score is important, but it’s not the only factor.

What Is Considered a Good Credit Score in the UK?

In most UK credit score ranges:

- “Good” or “Excellent” is where lenders offer competitive rates

- “Fair” may still secure approval but at higher interest

- “Poor” often leads to rejection or limited offers

Generally:

- Experian: 881+ is strong

- Equifax: 671+ is strong

- TransUnion: 604+ is strong

But each lender uses internal risk models as well.

How Credit Score Are Calculated

Credit score are based on data in your credit report, including:

Payment History

Late payments significantly lower your score.

Credit Utilisation

Using a high percentage of your available credit can reduce your rating.

Length of Credit History

Longer, stable credit histories help improve your score.

Credit Applications

Multiple hard searches in a short period can temporarily reduce your score.

Public Records

CCJs, bankruptcies, or IVAs heavily impact credit score ranges.

Common Myths About Credit Score Ranges

Myth 1: There Is One UK Credit Score

False. Each credit agency calculates scores differently.

Myth 2: Checking Your Score Lowers It

Checking your own report (a soft search) does not affect your score.

Myth 3: You Need Debt to Have a Good Score

You need responsible credit usage, not high debt.

How to Improve Your Position Within Credit Score Ranges

If your score falls into the lower credit score, consider:

1. Register on the Electoral Roll

This improves identity verification.

2. Pay Bills on Time

Payment history is one of the biggest factors.

3. Reduce Credit Utilisation

Aim to use less than 30% of your available credit.

4. Avoid Frequent Applications

Space out credit applications.

5. Correct Report Errors

Dispute inaccuracies with the credit agency.

Improvement takes time. Most positive changes show within 3–6 months.

How Lenders Use Credit Score Ranges

UK lenders often:

- Set minimum internal thresholds

- Use automated risk models

- Combine score data with affordability checks

For mortgages especially, lenders focus heavily on:

- Income-to-debt ratio

- Employment stability

- Deposit size

Credit score ranges support decision-making but don’t replace underwriting.

Credit Score Ranges and Mortgages

Mortgage lenders typically look for applicants within “Good” or “Excellent” credit score.

However:

- Specialist lenders accept lower scores

- Larger deposits can offset weaker credit

- Stable income strengthens applications

Improving your score before applying can significantly reduce mortgage rates.

How Often Do Credit Score Ranges Update?

Most UK credit agencies update monthly, depending on when lenders report.

You can monitor changes through:

Regular monitoring helps detect fraud or reporting errors early.

Are Credit Score Ranges the Same as Credit Reports?

No.

- Credit score ranges = numerical summary

- Credit report = detailed financial history

Lenders examine both.

Long-Term Financial Strategy and Credit Score Ranges

Improving it is not about quick fixes. It requires:

- Consistent repayment behaviour

- Responsible borrowing

- Long-term financial stability

- Controlled debt levels

Financial discipline matters more than temporary boosts.

Frequently Asked Questions About Credit Score Ranges

What are credit score in the UK?

Credit score ranges classify your creditworthiness into bands such as Very Poor, Fair, Good, and Excellent based on your financial history.

What is a good credit score within UK credit score ranges?

A good credit score generally falls within the “Good” or “Excellent” bands defined by Experian, Equifax, or TransUnion.

Do lenders use the same credit score ranges?

No. Each lender uses internal risk models alongside credit reference agency data.

How can I move up in credit score?

Improving payment history, lowering credit utilisation, registering on the electoral roll, and avoiding multiple applications can help.

How often do credit score update?

Most UK credit score update monthly based on lender reporting cycles.

Final Thoughts on Credit Score

Understanding credit score gives UK consumers greater control over their financial future. While the number itself is important, lenders assess broader financial behaviour, affordability, and stability.

The key to improving your standing within credit score ranges is consistency, transparency, and responsible borrowing habits over time.

Strong credit builds stronger financial opportunities.