Improve Credit Score UK: How to Boost Your Rating in 2026

If you want to improve credit score UK, you are not alone. Many people struggle to get approved for loans, credit cards, or mortgages because of a low credit score. However, the good news is that your credit score can improve with the right steps.

In this guide, you will learn how to improve your credit score in the UK, what affects it, and which actions work fastest in 2026.

What Does “Improve Credit Score UK” Mean?

To improve your credit score UK means increasing your credit rating with UK credit reference agencies. These agencies track how you manage money and share this data with lenders.

In the UK, the main credit agencies are:

- Experian – https://www.experian.co.uk

- Equifax – https://www.equifax.co.uk

- TransUnion – https://www.transunion.co.uk

Each agency uses a different scoring system. However, all lenders look for the same things: reliability, stability, and low risk.

Why Improving Your Credit Score UK Is Important

A higher score makes a real difference. For example:

- You get better interest rates

- You receive higher approval chances

- You pay less over time

- You gain access to premium financial products

Because of this, improving your credit score in the UK can save you thousands of pounds.

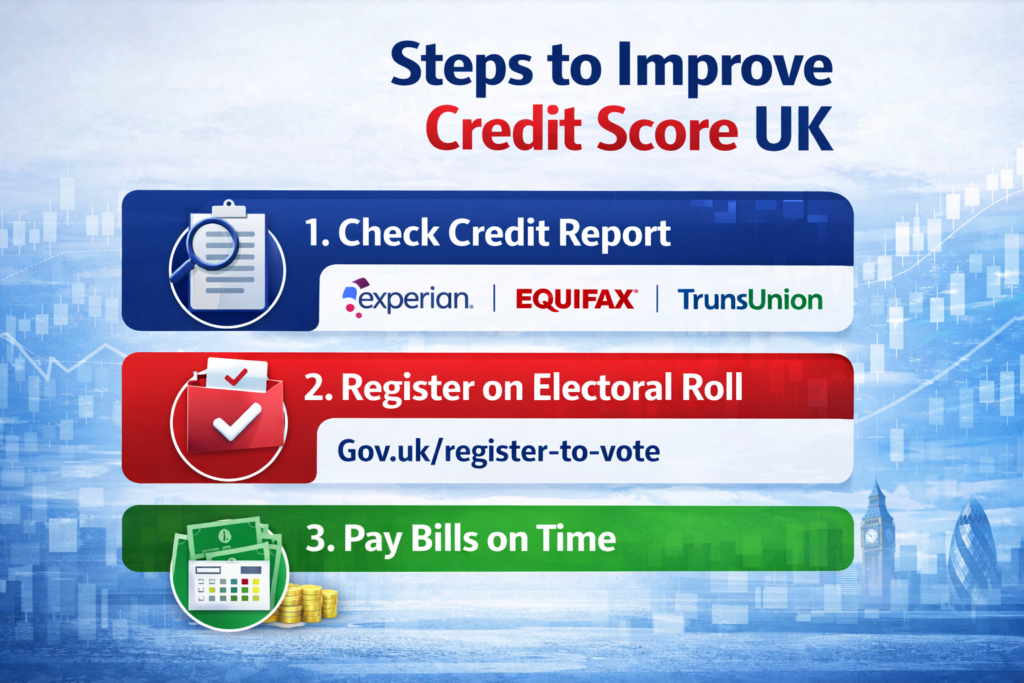

How to Improve Credit Score UK: Proven Steps

Below are practical and proven ways to improve your credit score UK.

1. Check Your Credit Report First

Before doing anything else, check your credit report.

Mistakes are common. For example, old addresses, closed accounts, or incorrect late payments can lower your score.

You can check your report for free at:

- Experian: https://www.experian.co.uk/consumer

- Equifax: https://www.equifax.co.uk/consumer

- TransUnion: https://www.transunion.co.uk/consumer

If you spot errors, contact the agency immediately. Fixing mistakes is one of the fastest ways to improve your credit score UK.

2. Register on the Electoral Roll

Registering to vote is one of the easiest ways to improve your credit score UK.

Lenders use the electoral roll to confirm your identity and address. Without it, approval becomes harder.

You can register here:

In many cases, this alone can raise your score within a few weeks.

3. Pay Bills on Time, Every Time

Payment history matters more than anything else.

Therefore:

- Pay credit cards on time

- Pay loans on time

- Pay utility bills on time

Even one missed payment can damage your score for months. To avoid this, use direct debits whenever possible.

4. Lower Your Credit Usage

Credit usage shows how much of your available credit you use.

For best results:

- Keep usage below 30%

- Avoid maxing out cards

For example, if your limit is £3,000, try to stay under £900. Lower usage signals control and helps improve your credit score UK faster.

5. Avoid Multiple Credit Applications

Each hard credit check leaves a mark.

If you apply for several products in a short time, lenders may see you as risky. Instead:

- Space applications by several months

- Use soft checks where possible

Many lenders now offer eligibility checks that do not affect your score.

6. Build Credit with the Right Products

If you have a low or thin credit history, consider:

- Credit-builder credit cards

- Small, manageable credit limits

Use them lightly and repay in full each month. Over time, this builds trust and helps improve your credit score UK safely.

7. End Financial Links with Ex-Partners

Joint accounts create financial links.

If you no longer share finances with someone, ask credit agencies to remove the association. This prevents their credit issues from affecting yours.

How Long Does It Take to Improve Credit Score UK?

Improving your score is not instant, but progress is possible.

- Small fixes: 4–8 weeks

- Medium improvements: 3–6 months

- Major recovery: 6–12 months

Consistency matters more than speed.

Common Mistakes to Avoid

To protect your progress:

- Do not miss payments

- Do not withdraw cash on credit cards

- Do not close old accounts without reason

- Do not ignore your credit report

Avoiding these mistakes keeps your score stable while it grows.

Improve Credit Score UK: Final Thoughts

To improve your credit score UK, you need patience, discipline, and the right strategy. Start with your credit report, pay everything on time, keep balances low, and avoid unnecessary applications.

By following these steps, you put yourself in a strong position to access better financial opportunities in 2026 and beyond.

FAQ

How can I improve my credit score UK quickly?

Fix report errors, register to vote, and lower credit usage.

Does checking my credit score lower it?

No. Checking your own score does not affect your rating.

Can a bad credit score improve?

Yes. With consistent payments and smart credit use, scores improve over time.

About UK Credit Scoring

Credit scores in the UK are managed by Experian, Equifax, and TransUnion. Lenders such as banks, mortgage providers, and finance companies use these reports to assess risk. This guide follows publicly available guidance from UK financial institutions and credit reference agencies.